As Aussies grapple with rising prices and financial pressures, the Consumer Data Right (CDR), designed to give consumers greater control over their personal and financial data, could offer some relief to households across the country hard done by the cost of living crisis. Apart from transforming how we interact with financial services, the CDR could potentially save us time, hassle, and most importantly – money.

Let's face it — switching financial providers has always been a pain. It's no wonder 58% of us said that we would switch if only it were more convenient, according to a recent financial wellness survey conducted by WeMoney. The current process is far from ideal, with 48% of surveyed Australians reporting it took them between two weeks and over two months to refinance or consolidate loans. That's a lot of time and hassle, especially when you're already stretched thin and worn down by the cost of living crunch.

But here's the kicker — many of us aren't even aware we're overpaying for financial products, such as loans and mortgages. A whopping 37% of surveyed Australians from the same survey haven't even checked if they have the best interest rate for their loan, despite the fact that 55% felt they were shelling out too much for financial services and products.

Clearly, the way we’ve been conditioned to interact with financial services and products isn’t quite optimal for our financial well-being. The good news, however, is that there might already be a solution out there.

The CDR’s promise

The CDR is a regulatory framework introduced by the Australian government to give consumers greater control over our personal data. Designed to make your financial life simpler and more transparent, the CDR allows you to share your data with accredited third parties securely, making it hassle-free to compare financial products and switch providers.

Enhanced control: You decide who can access your financial data, how they can use it, and for how long. This puts you in the driver’s seat whenever you interact with a financial service provider.

More personalisation: By sharing your data with different financial service providers, you can receive personalised offers that match your specific needs, helping you find better deals on loans, credit cards, mortgages, and dozens of other financial products that we rely upon.

Healthy competition: With more personalised data available, financial institutions and service providers would no longer be able to rest on their laurels expecting their customers to always return to them by default. Especially with the introduction of the Action Initiation Bill, consumers now have even more control — you can now authorise certain actions, such as switching providers or opening or closing an account, directly through the CDR framework. This shift puts increased pressure on financial services and product providers to consistently offer high-quality products and services as they will now have to compete on merit much more, ultimately offering better rates and services and leading to a more competitive and efficient marketplace. The result? A financial landscape where consumers are truly empowered, with their most ideal options at their fingertips.

How does the CDR work?

Data sharing with consent

You can choose to share your financial data with accredited data recipients, from banks and fintech companies to personal financial management (PFM) apps. This sharing is only done with your explicit consent, ensuring you have full control over your information.

But the CDR goes beyond just financial services — for instance, confirming your income when signing up for a Telstra phone plan, verifying your bank details for NIB health insurance claims, and even proving your age for online alcohol purchases, are just a few examples of how the CDR simplifies everyday processes.

Accredited data recipients

Only organisations that have passed rigorous accreditation by the Australian Competition and Consumer Commission (ACCC) can access your data. This ensures that your data is handled securely and ethically.

Secure data transfers

The data transfer process is designed to be secure and seamless. For instance, when using a loan matching platform such as Lendela, you can authorise it to access your bank statements in order to facilitate your application and match you with loan offers that are personalised to your financial profile. The bank verifies your identity, and your selected data is shared securely with Lendela.

Standardised data formats

Because the CDR requires that data be shared in standardised formats, the uniformity makes it easier to compare financial products across different providers. When data is standardised, information from different providers can be directly compared without needing to be reinterpreted or reformatted.

Again, this standardisation doesn’t just apply to financial products. Whether it’s switching from Telstra to Optus, NIB to HCF, or one energy provider to another, the CDR’s uniformity makes it easier for us to switch between service providers seamlessly. Large companies across various industries are recognising the value of CDR-enabled processes, helping to drive competition and, ultimately, better deals for Australians.

In the case of a loan matching platform, interest rates, fees, and loan terms from dozens of lenders are presented in a consistent format, making it easy for consumers to see which provider offers the best deal. The borrower data that Lendela would share with lenders in order to generate personalised loan offers would also be in a standardised format that makes it much easier and faster for lenders to process.

All of this comes together to ensure that you can make more informed financial decisions quicker and safer.

Why you should care about the CDR

The latest Australian Open Banking Ecosystem Map and Report from FinTech Australia paints a promising picture. The CDR ecosystem is maturing rapidly, with over 80 banks and 114 data holder brands online. On top of that, 20% of CDR use cases for banks involve lending, credit, and broking, shedding some light on its potential impact on borrowing and lending amid a cost of living crisis.

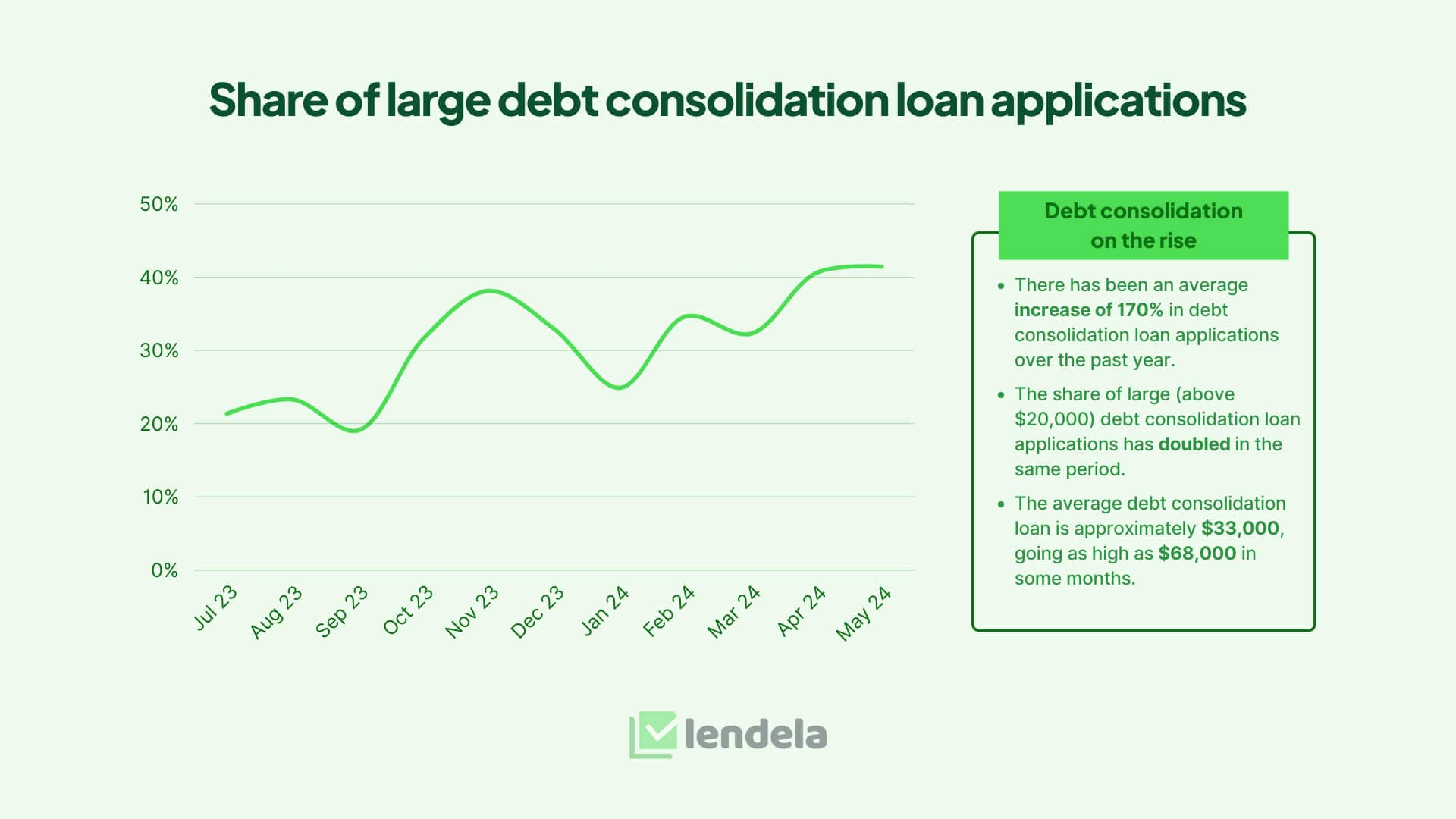

In recent months, Lendela has discovered that Australians have been relying on financial restructuring and alternative financing options to manage expenses and debt — according to data from Lendela’s report released in June 2024, The rapid rise of debt consolidation, there has been an average increase of 170% in the share of debt consolidation loan applications over the past year alone, with the share of large (above $20,000) debt consolidation loan applications doubling in the same period.

Source: Lendela media report - The rapid rise of debt consolidation

Source: Lendela media report - The rapid rise of debt consolidation

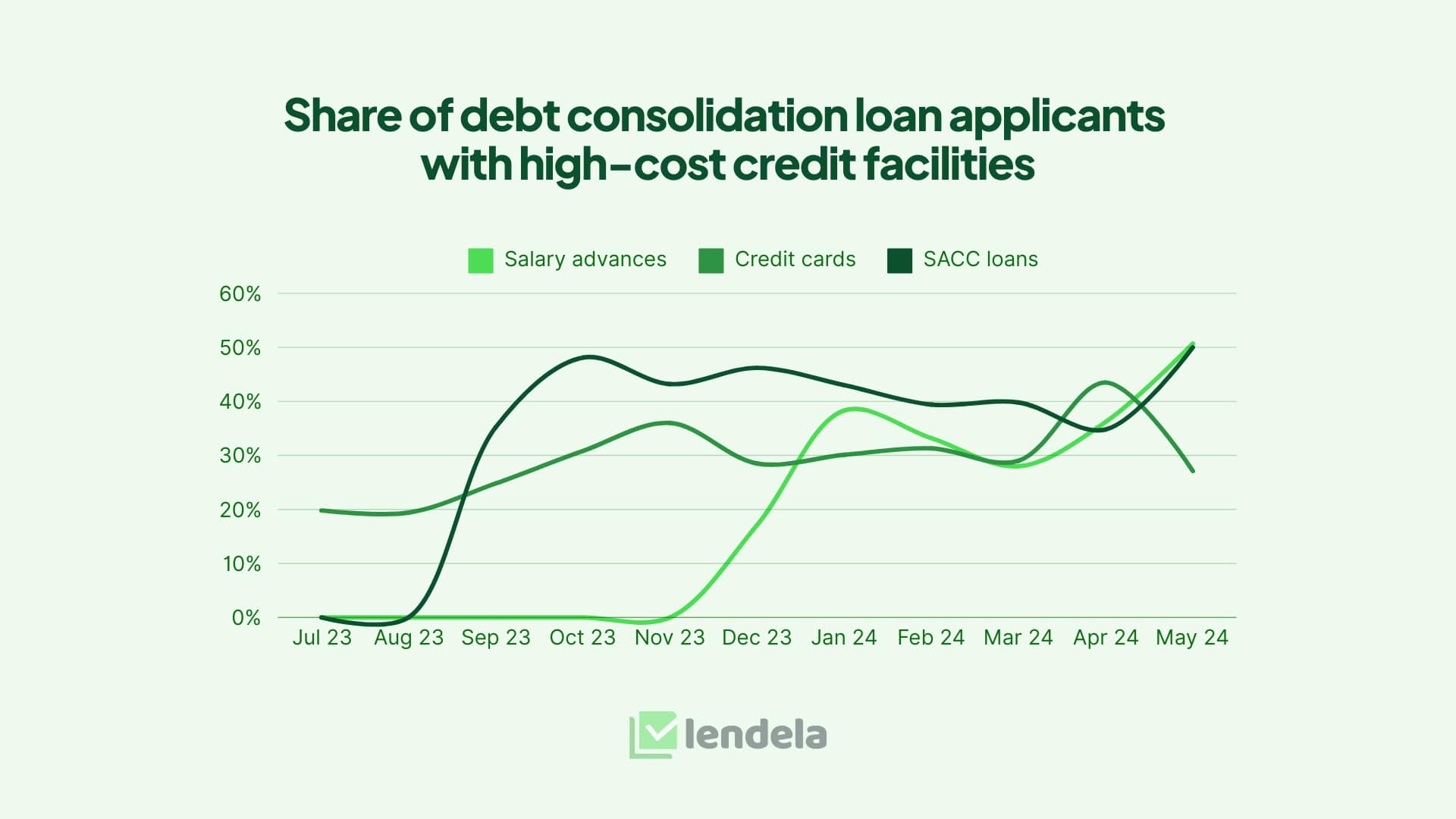

Other signs that point to growing consumer stress include the finding that many Australians are increasingly relying on high-cost credit options like BNPL, salary advances, and other revolving credit facilities, often unaware of the gamut of options and alternatives available to them.

Source: Lendela media report - The rapid rise of debt consolidation

Source: Lendela media report - The rapid rise of debt consolidation

Given the current economic climate, the ability to access personalised financing options and financial products, and seamlessly compare them across multiple providers, is absolutely crucial as it could potentially lead to tens of thousands of dollars in savings.

Borrowing made better

In the context of borrowing, the established norm has been to simply compare advertised loan rates on comparison sites, and while comparing tends to be an effective way to find your most competitive loan options, advertised rates are never personalised — this means that you’ll rarely, if ever, qualify for them, since each borrower’s financial profile is unique.

What then happens is that borrowers apply across multiple lenders to compare rates, inadvertently hurting their credit scores with multiple loan applications that can take up to weeks to finalise; essentially the kind of inefficiency the WeMoney survey findings above highlighted.

Now imagine that instead of this process, borrowers only have to fill in one application before instantly getting matched with personalised loan offers from multiple lenders. In a mere matter of minutes, a borrower can unlock over 20 personalised loan offers that have been pre-approved based on their unique financial profile, and receive their funds in as little as ten minutes.

This is not only what the CDR promises to do for lending, but what Lendela is already doing in Australia. As Australia’s only loan matching platform, Lendela has been using its unique matching engine — the reverse auction model — to match borrowers with personalised loan options from various lenders since 2023.

By bringing this model to Australia, Lendela aims to make borrowing cheaper, faster, and safer for Australians, and has already helped tens of thousands of Australians save thousands of dollars on repayments amid the cost of living crisis.

Making smarter financial decisions

Of course, there are still challenges the CDR needs to overcome before it can achieve its ambitious goals.

For one, data quality issues persist, and there's a need for better metrics on consumer usage and consent. But the trajectory is promising — the same Australian Open Banking Ecosystem Map and Report above revealed that the average time to fix implementation gaps has dropped from 119 days to 59 days in just six months.

As the Australian financial services industry charts its course in the era of Open Banking, the potential of the CDR to help millions of Australians navigate the cost of living crisis will make it harder and harder to ignore.

And as the CDR ecosystem continues to grow and mature, we can expect even more innovative solutions to emerge. The key is to stay informed and be willing to explore new tools that can help you take better control of your finances.